Swiggy Limited IPO: Review, Expert Analysis, and Investment Recommendations

Swiggy IPO- Overview

Swiggy, one of India’s leading food delivery and hyperlocal service platforms, has officially launched its much-anticipated Initial Public Offering (IPO), marking a significant milestone in the company’s journey since its founding in 2014. Swiggy’s IPO, valued at ₹11,327.43 crore, includes a fresh issue worth ₹4,499 crore (11.54 crore shares) and an offer for sale of ₹6,828.43 crore (17.51 crore shares). The IPO opened for subscription, with a price band set at ₹371-₹390 per share. Retail investors need a minimum investment of ₹14,820 for 38 shares, while employee allocations include a 750,000-share reservation at a ₹25 discount. Allotments will be finalized on November 11, with listing on the BSE and NSE anticipated for November 13, 2024. Founded in 2014, Swiggy is a leader in food delivery and hyperlocal services in India, with a significant presence through services like Instamart for grocery delivery, capturing a broad online market share.

IPO Subscription Period

The Swiggy IPO opensfor subscription from November 6, 2024, and will close on November 8, 2024. The finalization of the allotment is expected by November 11, 2024, with refunds being initiated the same day.

Pricing and Lot Details

The Swiggy IPO offers an opportunity to invest in one of India’s top food and grocery delivery platforms, with the IPO open from November 6 to November 8, 2024. Key details for potential investors include:

- Price Band: The IPO price is set between ₹371 and ₹390 per share.

- Lot Size: Investors must purchase a minimum of 38 shares, totaling approximately ₹14,820 for retail investors at the highest price.

- Issue Size: The IPO aims to raise around ₹11,327.43 crore, comprising a fresh issue of ₹4,499 crore and an offer for sale of ₹6,828.43 crore

- Face Value: Rs. 1 Per Equity Share

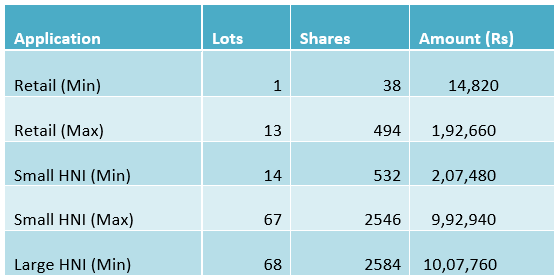

- The Swiggy IPO has a structured bidding system for different investor categories. Here’s a breakdown of the investment requirements for retail investors and high-net-worth individuals (HNIs):

Reservation Structure

The reservation structure for Swiggy’s IPO is divided as follows:

- Qualified Institutional Buyers (QIBs): 75% of the issue is reserved for QIBs. This segment includes mutual funds, foreign institutional investors, and other large financial entities.

- Non-Institutional Investors (NIIs): 10% of the issue is allocated for non-institutional investors, often high-net-worth individuals (HNIs) who invest in larger lot sizes.

- Retail Investors: 15% of the IPO is reserved for retail investors, with a minimum bid of 38 shares per lot, allowing for smaller individual investments.

- Employee Reservation: Swiggy has reserved up to 750,000 shares for employees, offered at a ₹25 discount per share within the IPO price band of ₹371-₹390

This structure balances institutional and retail participation, while the employee reservation encourages internal engagement in the company’s growth.

Key Dates & Timelines

Swiggy IPO Timeline (November 2024)

- IPO Open Date: Wednesday, November 6, 2024

- IPO Close Date: Friday, November 8, 2024

- Basis of Allotment: Monday, November 11, 2024

- Initiation of Refunds: Tuesday, November 12, 2024

- Credit of Shares to Demat Accounts: Tuesday, November 12, 2024

- Listing Date on BSE and NSE: Wednesday, November 13, 2024

Book Running Lead Managers

The Swiggy IPO is being managed by a group of Book Running Lead Managers (BRLMs), including:

- Avendus Capital Pvt Ltd

- BofA Securities India Limited

- Citigroup Global Markets India Private Limited

- ICICI Securities Limited

- J.P. Morgan India Private Limited

- Jefferies India Private Limited

- Kotak Mahindra Capital Company Limited

The registrar for the IPO is Link Intime India Private Limited, which will handle the processing of applications and allotments

Promoters Information

Swiggy’s promoters are primarily its three co-founders: Sriharsha Majety, Nandan Reddy, and Rahul Jaimini.

- Anand Kripalu – Independent Director and Chairman since December 2023. He holds a B.Tech from IIT Madras, a PG Diploma from IIM Calcutta, and an advanced management program from The Wharton School. Kripalu is the Global CEO of EPL Limited and has held senior roles at Diageo’s United Spirits, Cadbury Schweppes, Hindustan Lever, and DCM Data Products. He has received the “Lifetime Achievement Award” at the Indian Marketing Awards.

- Sriharsha Majety – Managing Director and Group CEO of Swiggy. He holds a B.Tech from BITS Pilani and a post-graduate diploma from IIM Calcutta. With over 10 years at Swiggy, he was named ‘Entrepreneur of the Year 2019’ at The Economic Times Awards for Corporate Excellence.

- Lakshmi Nandan Reddy Obul – Whole-time Director and Head of Innovation at Swiggy. He holds a Master’s in Physics from BITS Pilani and has over 10 years of experience with Swiggy. Before joining the company, he worked in business consulting at Intellecap.

The major institutional investor is Prosus, a subsidiary of the South African conglomerate Naspers, which holds approximately 33-40% of the company, and is looking to reduce this shareholding through the IPO.

About Swiggy Limited.

Swiggy is a leading Indian technology-driven platform offering a variety of convenience services, including Food Delivery, Instamart for grocery delivery, Dineout for restaurant reservations, and SteppinOut for event bookings. As a pioneer in the hyperlocal commerce sector, it has quickly established itself as a leader in food delivery and quick commerce in India. The platform also includes services like Genie for product pick-up/drop-off and other hyperlocal activities.

Swiggy’s business model is enhanced by its membership program, Swiggy One, and several in-app payment solutions, including Swiggy Money, Swiggy UPI, and Swiggy-HDFC Bank credit card. The company also provides valuable services to restaurant and merchant partners through analytics-driven tools, supply chain solutions, and last-mile delivery services. By mid-2024, Swiggy employs 930 tech professionals, leveraging its technological capabilities to drive growth and operational efficiency.

The Indian food services market, which Swiggy operates within, is poised for significant growth, fueled by urbanization and rising consumer incomes. The online food delivery segment, in particular, is expected to grow from ₹640 billion in 2023 to ₹1,400-1,700 billion by 2028. Swiggy is positioning itself to capitalize on this, with a large user base in top cities and expanding reach in smaller towns. The rising Average Order Value (AOV) and increasing consumer demand for convenience further boost Swiggy’s success prospects.

Despite its strong competitive advantages, such as an innovative platform, a loyal user base, and synergies from its wide partner network, Swiggy faces challenges. These include the need to maintain user acquisition, scale operations, and address the supply-side constraints in India’s largely unorganised restaurant market. Swiggy’s strategy to overcome these risks focuses on retaining and growing its user base, expanding its partner network, and enhancing its technology infrastructure.

The company is also focused on expanding its quick commerce operations, improving brand recall, and optimizing its delivery network. However, Swiggy must address key risks, such as dependence on restaurant and merchant partners, managing Dark Stores efficiently, and overcoming the cultural preference for home-cooked food, which can limit the expansion of food services in certain regions.

IPO Objectives

The company intends to allocate the net proceeds from this issuance towards the following strategic purposes:

- Debt Repayment: A portion of the funds will be directed towards repaying or pre-paying some or all of Scootsy’s borrowings, thereby strengthening its overall financial position.

- Expansion of Dark Stores: Funds will be utilized to support the expansion of Scootsy’s Dark Store network, enhancing its ability to provide faster services in the Quick Commerce segment. This includes making necessary lease or license payments for new store locations.

- Technology and Infrastructure Investment: A significant portion of the proceeds will be invested in technology upgrades and cloud infrastructure, aimed at improving operational efficiency and supporting long-term business growth.

- Marketing and Branding: Funds will be allocated to marketing and promotional initiatives designed to increase brand awareness and expand Scootsy’s visibility across different market segments.

- General Corporate Purposes: The remaining proceeds will be used for general corporate purposes, allowing for flexible allocation in response to evolving business needs.

Subscription Status

| Subscription Status as of 08 Nov’24’ | |

| Retail Individual Investor | 1.14 times |

| Non-Institutional Investor | 0.41 times |

| Qualified Institutional Buyers | 6.02 times |

| Employee | 1.65 times |

| Overall | 3.59 times |

Recommendation

Swiggy is a consumer-first technology company that provides a unified platform for food delivery, grocery shopping (Instamart), and on-demand deliveries. The company’s revenue from operations for FY2024, FY2023, and FY2022 were ₹11,634.35 crores, ₹8,714.45 crores, and ₹6,119.78 crores, respectively. However, Swiggy posted negative EBITDA figures for the same periods: ₹-1,835.57 crores in FY2024, ₹-3,910.34 crores in FY2023, and ₹-3,233.76 crores in FY2022. Similarly, the Profit After Tax (PAT) was negative, with ₹-2,255.95 crores in FY2024, ₹-4,192.17 crores in FY2023, and ₹-3,631.23 crores in FY2022.

For its IPO, Swiggy is issuing shares with a pre-issue EPS of ₹-10.70 and a post-issue EPS of ₹10.07. The pre-issue P/E ratio is -36.44x, while the post-issue P/E ratio is -38.72x, significantly lower than the industry’s average of 634.50x. Additionally, the company’s Return on Equity (RoE) for FY24 is -30.16%.

The Grey Market Premium (GMP) shows no expected listing gains (0%). Given the company’s financial performance and IPO valuation metrics, we recommend avoiding Swiggy’s IPO for both short-term listing gains and long-term investments.